Recognizing the Fundamentals of Buck Buy Sell: An Overview for Savvy Traders

Navigating the intricacies of dollar buy and sell purchases requires a solid grasp of essential ideas. Smart investors must recognize money pairs, pips, and the myriad variables that influence the buck's value. By incorporating technological and essential evaluation with effective danger monitoring, traders can boost their decision-making. Several overlook important methods that can substantially influence their end results. Exploring these techniques might expose possibilities that could alter the program of their trading journey.

The Basics of Money Trading

Money trading, typically referred to as foreign exchange trading, involves the exchange of one money for an additional in the worldwide market. This market operates 24-hour a day, covering several time areas, and is one of the largest monetary markets on the planet. Traders involve in money trading to maximize variations in exchange prices, getting money they anticipate to appreciate while selling those they prepare for will decrease.

Key concepts consist of currency sets, which stand for the worth of one money against one more, and pips, the smallest cost activity in the marketplace. Take advantage of is likewise a crucial aspect, enabling traders to regulate bigger positions with a smaller quantity of funding. Understanding market patterns and rate charts is important for making informed choices. Effective currency trading calls for strategy, knowledge, and risk management, as the volatility of the forex market can result in considerable gains or losses quickly.

Variables Influencing Dollar Worth

Several key elements influence the worth of the U.S. buck in the global market. Economic indicators, such as GDP growth, work prices, and inflation, play a considerable duty in shaping perceptions of the buck's toughness. When the U - Dollar Buy Sell.S. economic climate carries out well, confidence in the dollar boosts, typically causing admiration against various other currencies

Rates of interest established by the Federal Get are vital as well; higher prices generally attract foreign financial investment, enhancing demand for the dollar. Furthermore, geopolitical security and profession relationships impact its value; uncertainty or conflict can result in a weaker dollar as investors look for much safer possessions.

Supply and demand dynamics also impact the buck's value. As an example, when more dollars are in blood circulation without matching financial development, the buck might drop. Market sentiment and conjecture can drive variations, as investors react to information and trends influencing perceptions of the buck's strength.

Studying Market Trends

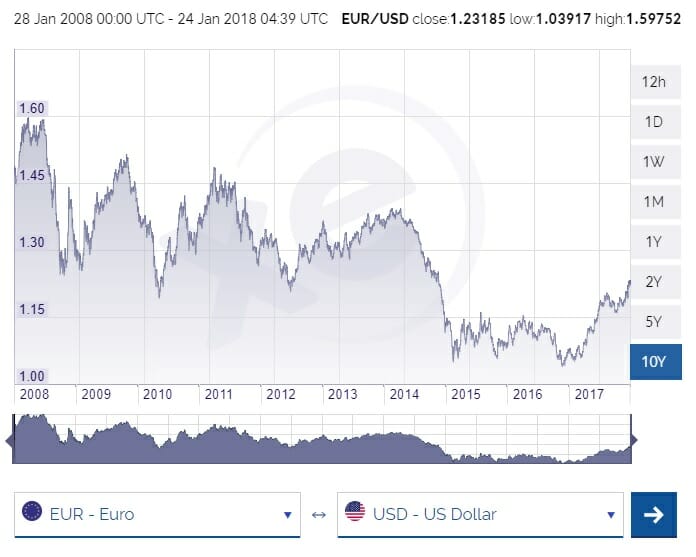

Recognizing market trends is important for traders seeking to take advantage of on fluctuations in the buck's value. Assessing these fads entails analyzing historical information and current market indications to determine patterns that might recommend future movements. Traders frequently make use of tools such as relocating averages, pattern lines, and energy indications to gauge the dollar's efficiency relative to other money.

Furthermore, financial reports, geopolitical occasions, and reserve bank policies play a significant function fit market belief. A solid work record could signal financial growth, possibly leading to a more powerful dollar. On the other hand, political instability can develop uncertainty, influencing the buck negatively.

Techniques for Purchasing and Selling Dollars

While guiding with the intricacies of the forex market, investors must develop effective methods for dealing dollars to maximize their revenues. One typical strategy is technical analysis, where investors use historical cost data and graph patterns to forecast future movements. Dollar Buy Sell. This can involve recognizing assistance and resistance degrees or using indicators like relocating standards

Fundamental analysis likewise plays an essential duty, as traders assess economic signs, rate of interest, and geopolitical events that can affect dollar value.

In addition, adopting a disciplined trading plan assists traders specify their entry and exit factors, ensuring they act emphatically instead of emotionally.

Using restriction orders can assist traders get or market bucks at fixed prices, boosting efficiency. Expanding currency pairs can decrease exposure and increase prospective possibilities. By integrating these techniques, investors can browse the buck market with higher self-confidence and check over here efficiency.

Taking Care Of Risks in Money Transactions

Assessing Market Volatility

Market volatility plays a vital role in money transactions, influencing the decisions traders make in the fast-paced forex environment. Understanding market changes is very important, as these variants can substantially affect money values and trading strategies. Traders commonly evaluate aspects such as financial indicators, geopolitical events, and market belief to determine volatility. Devices like the Ordinary True Array (ATR) or Bollinger Bands might aid in measuring volatility degrees, supplying understandings right into possible rate activities. In addition, identifying periods of increased volatility can enable traders to make informed choices, enhancing their capacity to exploit on opportunities while mitigating threats. Inevitably, a complete assessment of market volatility is crucial for effective money trading and threat management.

Establishing Stop-Loss Orders

To successfully handle dangers in money deals, investors usually apply stop-loss orders as an essential tool. A stop-loss order automatically activates a sale when a currency reaches a predetermined rate, minimizing prospective losses. This technique allows investors to establish clear limits on their threat exposure, making it much easier to abide by their trading plans. By establishing stop-loss levels based on market analysis or private risk tolerance, investors can secure their resources from sudden market changes. Stop-loss orders can reduce psychological decision-making throughout unpredictable market problems, ensuring that investors stay disciplined. Generally, including stop-loss orders into a trading strategy is a prudent approach to securing investments in the dynamic landscape of currency trading.

Branching Out Money Holdings

Stop-loss orders offer as a basic technique for risk management, yet investors can furthermore enhance their defense by expanding their money holdings. By spreading investments throughout several currencies, investors can alleviate threats related to money fluctuations. This approach permits them to profit from varying financial conditions and geopolitical advancements that might affect particular currencies in different ways. As an example, if one currency drops, gains in another can help support overall portfolio value. Diversity can decrease direct exposure to currency-specific over at this website events, such as political instability or financial slumps. When building a diversified portfolio, investors should consider factors such as liquidity, volatility, and connection among money. Inevitably, a well-diversified currency technique can cause more consistent returns and reduced overall risk.

Devices and Resources for Traders

While maneuvering with the complexities of money trading, investors depend greatly on a variety of resources and devices to enhance their decision-making procedures. Charting software is crucial, enabling investors to envision price activities and recognize trends. Real-time data feeds offer today market information, making it possible for fast reactions to fluctuations. Economic schedules, highlighting key monetary events, assistance traders anticipate market changes influenced by economic reports.

Furthermore, trading systems furnished with analytical devices facilitate approach advancement and implementation. Many investors additionally utilize threat administration calculators to establish excellent placement dimensions and possible losses. On-line forums and instructional internet sites work as beneficial sources for sharing insights and methods within the trading area. Lastly, mobile applications offer the benefit of trading on the move, making sure that traders continue to be engaged with the marketplace whatsoever times. Altogether, a well-rounded toolkit is important for informed and calculated trading in the dynamic money market.

Frequently Asked Inquiries

What Are the Trading Hours for Currency Markets?

Currency markets run 24 hours a day, five days a week. Trading begins on Sunday evening and proceeds until Friday evening, enabling participants around the world to participate in trading any time.

How Do Geopolitical Events Impact Buck Trading?

Geopolitical occasions greatly impact dollar trading by affecting investor view, changing supply and need dynamics, and prompting changes in financial plan. Such advancements can result in money volatility, impacting traders' choices and market stability.

What Is the Function of Reserve Bank in Currency Trading?

Reserve banks affect money trading by setting passion rates, controlling cash supply, and interfering in international exchange markets. Their plans impact money values, investor self-confidence, and general market stability, making them critical in international monetary systems.

Can I Profession Dollars Using a Mobile Application?

Yes, individuals can trade dollars using mobile applications. These platforms give accessibility to real-time market information, facilitate purchases, and usually provide user-friendly interfaces, making money trading obtainable to a broader target market.

Exist Tax Obligation Implications for Trading Dollars?

Tax obligation implications for trading dollars exist, as profits might go through resources gains tax. Traders should consult tax experts to recognize their certain responsibilities, including coverage demands and prospective deductions associated with currency deals.

Currency trading, often referred to as foreign exchange trading, entails the exchange of one currency for another in the international market. Trick principles include currency pairs, which represent the value of one money versus one more, and pips, the smallest cost activity in the market. Managing threats in money deals is essential for investors navigating with the complexities of the international exchange market. Market volatility plays a crucial duty in money deals, influencing the choices investors make in the fast-paced forex setting. By spreading investments across multiple money, investors can reduce risks connected with currency changes.